Get In Touch

- Phone + 123 5647 8900

- Email Meetpatel@gmail.com

- Address Based on Houston city, USA

- Follow us

- Work

- 1 February 2026

How Can Technology Revolutionize Cannabis Delivery?

The cannabis industry attracts attention for all the wrong reasons. Most conversations revolve around hype, fast money, or surface-level trends. Very few people talk about the underlying infrastructure that makes or breaks real businesses in this space. Dispensaries sit at the center of that infrastructure, and once you study them closely, you realize they are not just retail outlets. They are highly regulated distribution systems designed to operate under constraint.

I wasn’t planning to write about dispensaries. I was doing what most people do when they get curious about a space. Browsing online. Reading articles. Skimming listings. Watching how businesses present themselves. That’s when something stood out. A surprising number of cannabis dispensaries were quietly up for sale. Not distressed. Not shut down. Fully operational, licensed, and marketed as “turnkey.”

At first glance, it looked like an opportunity. A functioning dispensary, existing customers, systems in place. Walk in, take over, scale. That narrative is tempting. But cannabis is not an industry where appearances tell the full story, and experience has taught me that when the same pattern repeats itself, there is usually a deeper reason behind it.

According to industry estimates, the legal cannabis market in the United States alone has crossed $33 billion in annual sales, with dispensaries accounting for the majority of direct consumer revenue. Yet a significant number of dispensaries fail or change ownership within their first few years. The reason is rarely demand. It is almost always executed.

That’s when I started digging deeper. I spent months studying cannabis dispensaries the boring way. Reports. Store visits. Owner interviews. Location data. Profit breakdowns. Consumer behavior. I wasn’t chasing hype. I was chasing patterns. Somewhere between zoning laws and foot-traffic heatmaps, the blueprint became clear.

A dispensary is not a weed store. It is a retail business wrapped in regulation, psychology, and timing. When done right, it becomes a predictable cash engine. When done wrong, it bleeds money quietly. This article is my attempt to document what actually matters, stripped of fluff, written for people who want clarity, not fantasies.

Turnkey Does Not Mean Trouble-Free

Industry data shows that a large percentage of dispensaries change ownership within their first few years. Demand is not the issue. Structure is. Many dispensaries go up for sale not because the business failed, but because the operational burden is heavier than expected. Compliance fatigue, capital strain, licensing complexity, and margin pressure push owners to exit once the learning curve flattens.

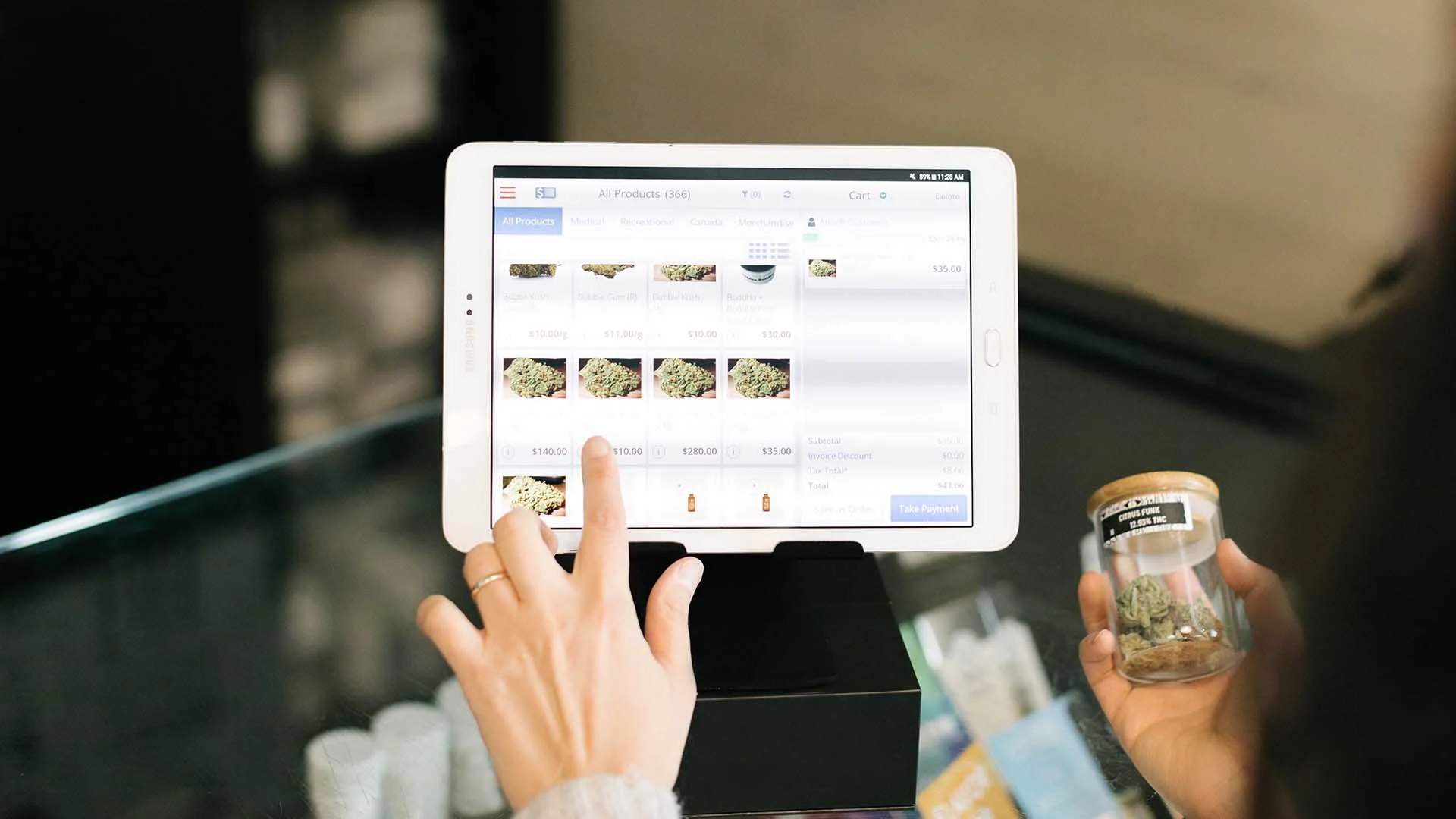

Turnkey Does Dispensaries Are Distribution Engines, Not Retail StoresNot Mean Trouble-Free

A dispensary should never be evaluated like a conventional retail store. Unlike traditional retail, where poor decisions may hurt margins, mistakes in cannabis can shut down operations entirely. Every dispensary operates at the intersection of compliance, logistics, customer education, and supply chain control. The businesses that last understand this early. Those that don’t usually learn through expensive consequences.